Welcome to our comprehensive guide on Understanding Financial Service Cloud Pricing! Whether you are a financial professional or a business owner looking to invest in a cloud-based financial service solution, this article will provide you with all the essential information you need to know about pricing. Financial Service Cloud is a powerful platform that enables financial institutions to deliver personalized, efficient, and secure financial services to their clients. With its wide range of features and capabilities, it is essential to understand how the pricing structure works to make an informed decision. So, let’s dive in and explore the intricacies of Financial Service Cloud Pricing!

Understanding Financial Service Cloud Pricing Models

Financial Service Cloud offers several pricing models to cater to the diverse needs of its users. By understanding these pricing models, businesses can choose the one that aligns with their requirements and budget. Let’s explore the different pricing options offered by Financial Service Cloud.

1. Per User Pricing: This pricing model is based on the number of users who will be using the Financial Service Cloud platform. Businesses pay a fixed amount for each user, usually on a monthly or annual basis. This model is ideal for small and medium-sized enterprises (SMEs) with a limited number of users. It allows for accurate budget allocation and ensures businesses only pay for the licenses they need. Additionally, this pricing model offers scalability, allowing businesses to easily add or remove users as their needs change.

With per user pricing, businesses are provided with access to all the features and functionalities of Financial Service Cloud. This includes customer management, data analytics, personalized advice, and more. Pricing may vary based on the level of support and customization required.

2. Enterprise Pricing: For larger organizations with complex requirements and a higher number of users, Financial Service Cloud offers enterprise pricing. This model is designed to meet the specific needs of large-scale financial service providers, such as banks, insurance companies, and wealth management firms. It provides advanced features, customizations, and tailored support to ensure seamless integration with existing systems and processes.

Enterprise pricing is typically determined on a case-by-case basis, taking into account factors such as the size of the organization, the scope of implementation, and the level of customization required. It offers flexibility and scalability, allowing businesses to adapt the platform to their evolving needs. Advanced security features, data management tools, and integration capabilities are also included in the enterprise pricing model, making it suitable for businesses that require a high level of control and compliance.

3. Pay-Per-Use Pricing: This pricing model is based on the actual usage of Financial Service Cloud’s features and functionalities. Instead of paying a fixed amount per user, businesses are billed for the specific services they utilize. This option offers flexibility and cost-effectiveness, particularly for businesses with fluctuating user counts or varying usage patterns.

Pay-per-use pricing allows businesses to access all the features of Financial Service Cloud without committing to a fixed number of licenses. It enables businesses to scale their usage up or down as needed, ensuring they only pay for the services they utilize. This pricing model is beneficial for businesses undergoing periods of growth, experiencing seasonal fluctuations, or operating on a project basis.

Financial Service Cloud pricing models aim to provide businesses with options that suit their specific requirements and budgets. By understanding these models, businesses can make informed decisions about which pricing option aligns best with their needs. Whether it’s per user pricing, enterprise pricing, or pay-per-use pricing, Financial Service Cloud offers flexibility, scalability, and a range of features to enhance the financial operations and customer management of businesses in the financial services sector.

Key Factors Influencing Financial Service Cloud Pricing

When considering the pricing of Financial Service Cloud, there are several key factors that influence the cost. These factors take into account various aspects such as the size of the organization, the level of customization required, and the specific needs of the financial services being provided. Understanding these factors will help businesses make informed decisions when it comes to budgeting for their cloud service.

1. Organization Size: The size of an organization plays a vital role in determining the pricing of Financial Service Cloud. Larger organizations typically have greater demands in terms of storage, user access, and overall functionality. As such, they might require higher-tier service plans that can accommodate their specific needs. Smaller organizations, on the other hand, may opt for more cost-effective plans that offer essential features at a lower price point.

2. Customization Requirements: One of the critical factors influencing Financial Service Cloud pricing is the level of customization required. Financial institutions often have unique and complex demands, and customization allows them to tailor the cloud solution to their specific workflows and processes. The more customization needed, the higher the pricing could be. This is because customization often requires additional development work, integration with existing systems, and ongoing maintenance to ensure a seamless and efficient operation.

Furthermore, customization might involve the development of specific features or functionalities that are not part of the standard Financial Service Cloud offering. These customizations could range from creating bespoke user interfaces to building advanced data analytics tools for better decision-making. As a result, the pricing will ultimately depend on the extent of customization needed to meet the organization’s requirements.

3. Scalability and Usage: Scalability and usage considerations are also significant factors when determining Financial Service Cloud pricing. Financial institutions need cloud solutions that can accommodate their growth plans and handle increasing data volumes. The pricing structure often reflects the scalability options offered by various service providers.

Some cloud service providers may charge based on the number of users, storage space utilized, or the volume of data being processed. For organizations with fluctuating needs, such as seasonal businesses or those experiencing growth spurts, it is crucial to consider whether the pricing model is flexible enough to align with their changing demands.

4. Regulatory Compliance: The financial services industry is heavily regulated, and organizations must comply with various regulatory requirements. Financial Service Cloud providers invest in security measures, data encryption, and compliance certifications to ensure that their services meet industry standards.

The level of regulatory compliance built into the service offering can impact the pricing. For instance, a cloud service provider that has obtained the necessary certifications and adheres to strict data protection protocols might charge a premium for their services. This higher cost reflects the added security and compliance measures taken to protect sensitive financial information.

5. Support and Service Level Agreements (SLAs): The level of support and service provided by the cloud service provider is another crucial factor influencing pricing. Financial institutions rely on their cloud solution for critical operations, and any downtime or technical issues can have significant consequences.

Cloud service providers offering higher service levels, such as guaranteed uptime, round-the-clock support, and faster response times, typically charge a premium for their services. These enhanced service offerings provide peace of mind to financial institutions, knowing that their cloud solution is backed by reliable support and robust SLAs.

In conclusion, when considering the pricing of Financial Service Cloud, businesses need to take into account factors such as organization size, customization requirements, scalability and usage, regulatory compliance, and support and service level agreements. Evaluating these factors will help organizations make well-informed decisions and choose the most suitable cloud service provider that aligns with their unique needs and budgetary considerations.

Comparing Pricing Structures of Financial Service Cloud Providers

When it comes to choosing a financial service cloud provider, understanding the pricing structures offered by different providers is crucial. Pricing can vary significantly among providers, and it’s important to compare and evaluate your options to ensure you are getting the most cost-effective solution for your business needs. In this article, we will explore and analyze the pricing structures of various financial service cloud providers to help you make an informed decision.

1. Fixed Pricing:

Some financial service cloud providers offer a fixed pricing structure where you pay a set monthly or annual fee for access to their services. This pricing model is often suitable for businesses with predictable usage requirements and budget constraints. With fixed pricing, you can accurately forecast your expenses and avoid any unexpected cost variations. However, it may not be the most cost-effective option for businesses with fluctuating usage or those looking for more flexibility in their pricing arrangement.

2. Usage-Based Pricing:

Other financial service cloud providers adopt an usage-based pricing structure, where you pay based on the resources and services you consume. This model allows for more flexibility and scalability as you only pay for what you use. It can be advantageous for businesses with unpredictable or seasonal usage patterns. However, it is important to closely monitor your usage to ensure you don’t exceed your budget or end up paying for unused resources. Some providers also offer tiered pricing plans based on usage volume, providing cost advantages as your usage increases.

3. Hybrid Pricing:

Hybrid pricing is an emerging pricing structure offered by some financial service cloud providers. It combines elements of both fixed and usage-based pricing to provide a customized and flexible solution for businesses. With hybrid pricing, you get the predictability and stability of fixed pricing for certain services or features, while having the scalability and cost-effectiveness of usage-based pricing for others. This model appeals to businesses seeking a balance between cost control and flexibility, allowing them to allocate their resources efficiently in line with their specific needs.

For example, a financial service cloud provider may offer a fixed pricing structure for core services like customer relationship management (CRM) tools and document management systems. This allows businesses to have a predictable monthly cost for essential services irrespective of their usage. At the same time, the provider may offer usage-based pricing for additional features like data analytics tools or advanced compliance modules. This ensures that businesses pay only for the specific add-ons they require, providing flexibility and cost control.

It is essential to carefully evaluate your business requirements and assess the potential benefits and drawbacks of each pricing structure offered by financial service cloud providers. Factors such as the size of your business, the expected volume of data and transactions, and the scalability requirements should all be considered. Additionally, it is advisable to review any potential hidden costs, such as data storage fees or charges for technical support, to accurately compare the overall pricing structures of different providers.

Ultimately, choosing the right financial service cloud provider and pricing structure is imperative to ensure a cost-effective and efficient solution for your business. By analyzing and comparing the pricing structures of different providers, you can make a well-informed decision that aligns with your unique requirements and budget.

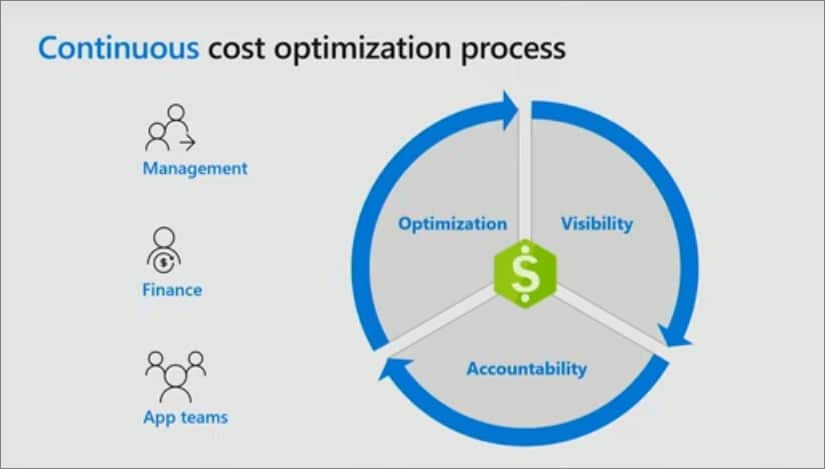

Strategies for Cost Optimization in Financial Service Cloud

Optimizing costs in Financial Service Cloud is crucial for organizations aiming to maximize their return on investment. By implementing smart strategies, businesses can streamline their operations, control expenses, and enhance their overall financial performance. Below are some effective strategies for cost optimization in Financial Service Cloud:

1. Evaluate and Optimize Licenses

One of the primary areas to focus on when optimizing costs in Financial Service Cloud is to evaluate and optimize the number of licenses being utilized. Many organizations tend to have more licenses than necessary, resulting in unnecessary expenditure. By regularly reviewing the licenses in use and eliminating any unused or underutilized licenses, businesses can significantly reduce their costs.

2. Embrace Automation

Automation plays a vital role in cost optimization in Financial Service Cloud. By automating repetitive and manual tasks, businesses can save time, increase efficiency, and reduce the need for additional human resources. Implementing automation tools and workflows can not only streamline processes but also minimize the chances of errors and improve overall data accuracy.

3. Utilize Data Storage Efficiently

Data storage is a significant component of Financial Service Cloud costs. To optimize costs in this area, organizations should focus on efficient data storage practices. This includes regularly reviewing and cleansing data, eliminating redundant or outdated information, and leveraging data compression techniques. By optimizing data storage, businesses can reduce storage costs and minimize the overall storage requirements.

4. Implement Scalable Architecture

To effectively optimize costs in Financial Service Cloud, it is essential to implement a scalable architecture. A scalable architecture allows businesses to adjust their resources and capacities based on their needs, preventing overprovisioning or underutilization of resources. By leveraging cloud-based technologies and infrastructure, organizations can scale up or down as needed, reducing unnecessary costs and optimizing resource allocation.

Furthermore, a scalable architecture enables organizations to handle increased workloads and accommodate growth without incurring substantial additional expenses. It provides the flexibility to adapt to changing business requirements and ensures that the infrastructure can support future expansion without significant investments or disruptions.

A scalable architecture also allows organizations to take advantage of pay-as-you-go models, where they only pay for the resources they use. This means that organizations can align their costs with their actual usage, avoiding unnecessary expenses incurred by maintaining fixed resources that are underutilized.

5. Regularly Monitor and Optimize System Configuration

Monitoring and optimizing system configuration is another crucial strategy for cost optimization in Financial Service Cloud. By regularly analyzing system configurations and settings, organizations can identify any potential bottlenecks, inefficiencies, or redundant features that may contribute to increased costs.

Furthermore, staying up-to-date with the latest updates, patches, and enhancements can help optimize system performance and reduce costs. Regularly reviewing and optimizing system configurations ensure that the organization is utilizing the platform to its fullest potential while minimizing unnecessary expenses.

In conclusion, implementing effective cost optimization strategies in Financial Service Cloud can help organizations maximize their ROI. By evaluating and optimizing licenses, embracing automation, utilizing data storage efficiently, implementing scalable architecture, and monitoring system configuration, businesses can streamline their operations, control expenses, and improve their overall financial performance.

Key Considerations for Choosing the Right Financial Service Cloud Pricing Plan

When it comes to selecting the right pricing plan for your financial service cloud, there are several key considerations that can help you make an informed decision. Here are some important factors to keep in mind:

1. Scalability

One of the major considerations while selecting a financial service cloud pricing plan is scalability. Your business needs may change over time, so it’s crucial to choose a plan that allows for easy scaling as your requirements grow. Make sure the pricing plan offers flexibility in terms of adding or removing users, increasing storage capacity, and accessing additional features as and when needed.

2. Pricing Structure

Understanding the pricing structure is vital when evaluating different financial service cloud plans. You should have a clear understanding of how the pricing is calculated and what factors affect the costs. Some plans may charge per user, per transaction, or based on the number of requests made. Carefully analyze your business needs and usage patterns to determine which pricing structure aligns best with your requirements.

3. Data Security

Since financial service cloud solutions handle sensitive client information, data security is of utmost importance. When considering pricing plans, make sure to evaluate the level of security measures and compliance certifications provided. Look for encryption capabilities, role-based access controls, and data encryption at rest and in transit. A robust security infrastructure ensures that your clients’ data remains protected, reducing the risk of any potential breaches.

4. Integration Capabilities

Integration capabilities play a crucial role in selecting an appropriate financial service cloud pricing plan. Assess the plan’s ability to integrate with your existing systems, such as customer relationship management (CRM) software or accounting platforms. Smooth data flow and seamless integration enable efficient and streamlined operations, allowing you to leverage the full potential of your financial service cloud.

5. Customer Support and Training

Customer support and training are often overlooked but are vital considerations when choosing a financial service cloud pricing plan. A robust support system ensures that you receive prompt assistance whenever an issue arises. Look for plans that offer dedicated customer support, preferably 24/7, as well as access to a knowledge base or training resources. Adequate training ensures that you and your team can make the most of the cloud platform’s features and functionalities.

Additionally, consider evaluating user reviews and testimonials to gauge the quality of customer support and training provided by the cloud service provider.

By considering these key factors, you can select the right financial service cloud pricing plan that aligns with your business objectives and budget. Remember, the chosen plan should not only meet your current requirements but also accommodate future growth and scalability.